What is life insurance?

Life insurance helps look after your loved ones financially when you’re no longer here. It pays out a sum of money if you pass away or are diagnosed with a terminal illness during the policy term. This payment can help your loved ones maintain their way of life and keep paying the bills. Our Life Insurance Plan has no cash-in value at any time. If you cancel the policy, the cover will end and you will get nothing back.

Do you need life insurance?

Life insurance is typically used to help protect the life you and your loved ones have built. This could mean:

- Fewer bills – help pay off the debts they have left, such as a mortgage

- Peace of mind – help reduce your family's money worries at what is a difficult time

- Financial support – to help your family carry on without you

How our life insurance works

- Pay a monthly premium for the policy term from £5 a month

The price you pay depends on the level and length of cover selected, as well as personal details such as your age, medical history and whether you smoke. - Option to place your policy into a trust

An Aviva Trust could give you more control over who your money goes to once you’re gone. - Lump sum payment if the worst happens

A lump sum will be paid if you pass away or are diagnosed with a terminal illness that meets our policy definition (and aren’t expected to live more than 12 months). Your loved ones could use the money however they like. Once the payout is made that’s the end of the cover.

Life insurance gift card

§ As a thank you for applying for our Life Insurance Plan by 28 February 2025, you'll be able to claim a gift card worth £120 after you have made 6 monthly payments. Offer T&Cs apply. You can choose from a Marks and Spencer, Tesco or Amazon.co.uk Gift Card*.

*Restrictions apply, see www.amazon.co.uk/gc-legal

Are you eligible for life insurance?

To apply for cover, you must:

- Be aged between 18 and 77

- Answer all questions we ask you truthfully

- Be in the UK with a legal right to live there. You must consider your main home to be in the UK (which doesn't include the Channel Islands, the Isle of Man or Gibraltar) and have no current intention of permanently moving elsewhere.

In most cases, you won’t need a medical exam. But if we do ask you to have one, we’ll cover the costs.

Life insurance explained

Learn more about the ins and outs of our Life Insurance Plan in the video below or use our life insurance glossary.

Transcript for video Our Life Insurance Plan

Life insurance explained

Life is full of the things you love – your family, your home, and the other things that make you happy. But it can be unpredictable, and we don't always know what's around the corner.

Our Life Insurance Plan is one of the ways you can protect what matters most to you. If you’re thinking about getting life cover, there are a couple of things to consider. Do you have a partner, children and a mortgage or other loans? What will your family need in the future?

We offer different types of cover: level cover and decreasing cover.

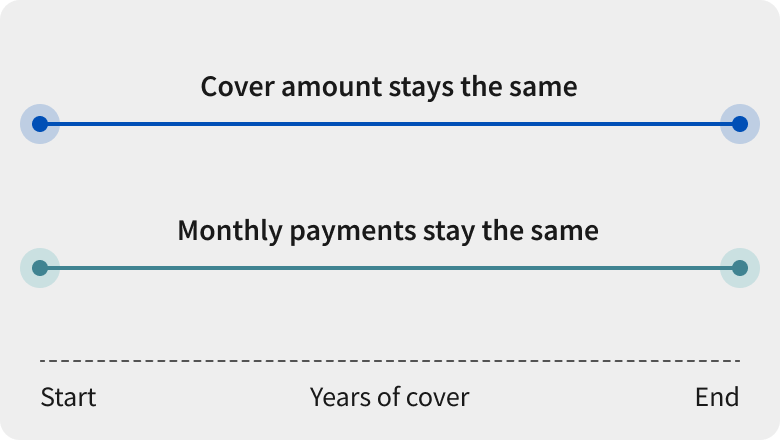

With level cover, what you pay each month stays the same for the whole term of the policy, and so does the cover amount.

If you’d prefer your cover amount to rise with the cost of living, you can choose to protect it against the effects of inflation, which means that what you pay will also increase over time.

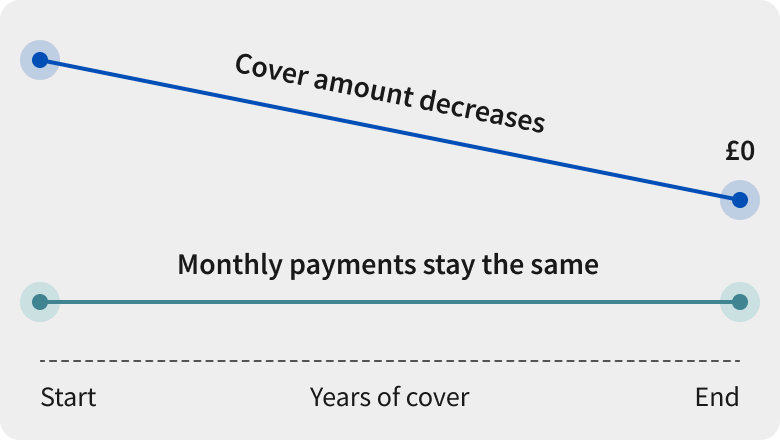

Decreasing cover works like a repayment loan with a fixed interest rate. So, the value of your cover decreases gradually, but the amount you pay stays the same.

When it comes to how much cover you’ll need, everyone’s different. If you have a mortgage, how much have you got left to pay, and how long for? Look at your current income and monthly outgoings – things like childcare costs, household bills and family holidays.

To help you decide how long you want your cover to last, consider how long your children are likely to depend on you financially, or when your partner is planning to retire.

At Aviva, our cover is designed with you in mind. With flexible cover length, simple claims and lump sum pay-outs – we’re here when you need us most.

We've got you covered

Protect your loved ones with our protection insurance, designed to shepherd you and your loved ones through tough times and beyond.

What our life insurance covers

Here’s more about what’s covered, and what to bear in mind before you go ahead.

What’s covered

Important to know

Policy documents

See a full list of what’s covered in our policy wording.

Life Insurance Plan policy summary (PDF 104 KB)

How long do I need life insurance for?

Life insurance is also known as term life insurance, which means it covers you for a specified amount of time – the ‘term’ of the policy. Think about how long your kids will need your financial support, if you’ve got a mortgage to pay, or when your other half might retire – this will help you gauge how long you need your cover. If you’re over 50 and want cover for the whole of your lifetime, rather than a fixed amount of time, you could consider Over 50 life insurance.

Joint or single life insurance policy?

If you and your partner would like combined cover, you can take out a joint policy. This pays out once and won’t provide cover for the second person after the first person passes away.

Another way would be to each take out a separate policy. So when there’s a pay out for one person their policy will end – but the second person’s policy will continue. The cost of two policies will generally be higher than a joint policy.

Discover more in our article about choosing between joint and separate policies.

How much cover will I need?

It’s worth totting up how much loved ones might need to pay off a mortgage or keep up repayments, settle any debts and cover general living costs. We have a tool to do just that.

Choosing your life cover

We offer two different types of life cover: level cover and decreasing cover.

Both are what we call term insurance policies – meaning they help protect your loved ones for a fixed amount of time, or term.

The type of cover you want may depend on what you want to protect and how much you’d like to pay each month.

Family protection – level cover

Choose a lump sum to leave behind for your loved ones and select how long you want your cover to run for. You’ll pay the same amount of premium for this cover each month until your policy ends.

If you pass away during this period, the lump sum can help to maintain the living standards of loved ones. It could be used to help pay off an interest-only mortgage, or go towards living costs and monthly outgoings, such as rent.

Protecting your cover from the effects of inflation

As level cover requires you to choose a lump sum payout, you can also choose to have your cover take inflation into account and increase this lump sum in line with rising prices over time.

If you take out this cover, your monthly payments may rise, but the lump sum won't be worth less in the future because of the rise in the cost of living.

For example, a £100,000 fixed lump sum would still be valued at £100,000 in 20 years’ time. However, the price of goods and services will have increased in that time - inflation - so your money won’t go as far.

The cover amount increases in line with the Consumer Prices Index (CPI), calculated over 12 months. To calculate the increase to your premium, we multiply what you pay by 1.5 and the percentage increase in CPI. If there’s no increase in the CPI, there’s no change to your cover or premium over a 12 month period. This option only applies to level cover. If you choose it, the maximum annual increase would be 15% to your premium and 10% to your cover.

Mortgage protection – decreasing cover

Although you don’t specifically need a mortgage to take out this cover, you might choose to do so to help your loved ones pay off a repayment mortgage or long-term loan if you pass away at any time during the policy term.

The amount you have left to pay on your mortgage usually drops over time, so mortgage protection life insurance decreases over time too. This is why it’s called decreasing cover, and why it usually costs less than level cover.

The cover lasts for a specific length of time of your choosing and your monthly premiums are fixed (unless you make changes to your policy).

Read more about mortgage protection life insurance.

Find out more about the difference between level cover and decreasing cover.

Why choose our life insurance?

Life insurance and critical illness cover

When you apply for life insurance, you can add critical illness cover. Critical illness cover pays a lump sum if you or your child are diagnosed with or have surgery for one of our 52 critical illnesses Footnote [3] covered by our plan within the policy term and live for 10 days after diagnosis. There's no cash in value at any time.

They are separate policies and cover you for different things, but you can buy them together.

Because they’re not combined, a successful critical illness claim won’t affect your life insurance policy, which will still pay out if you pass away during the policy term.

Aviva DigiCare+ by your side

Once you take out a new life insurance policy with us, taking positive strides towards a healthier lifestyle can be as easy as stretching for your phone.

You can access health and wellbeing services through the Aviva DigiCare+ app, and it won’t cost you extra. Once your cover is up and running, you can download the app, pop in your details, then use it to connect to clinicians, nutritionists, therapists and more.

These are the services stitched into the app:

- An annual health check

- Nutrition support

- Mental health support

- Second medical opinion

- Bupa Anytime HealthLine

- Bereavement support

- Legal services

Services are provided by Square Health and other trusted third party providers.

Of course, the main reason for taking out a policy with us is financial protection, and you shouldn’t get cover for Aviva DigiCare+ alone.

The Aviva DigiCare+ app and services are non-contractual and can be changed or withdrawn at any time.

The terms and conditions and privacy policy can be found within app. Residency restrictions apply.

Life insurance FAQs

Can I cancel my Life Insurance Plan at any time?

Does your Life Insurance Plan cover terminal illness?

What's the difference between our Life Insurance Plan and our Over 50 Life Insurance Plan?

If I receive a life insurance payout, will I need to pay tax on it?

Can I have more than one Life Insurance Plan?

What can I do if I am struggling to keep up with my monthly payments?

Am I covered by my employer’s life insurance policy?

When should I get life insurance?

What is the average cost of life insurance?

Looking for different cover?

We have other types of protection cover to help safeguard your family during difficult times.

Over 50 Life insurance

Guaranteed life insurance cover for the rest of your life that pays a lump sum when you die (unless you die within the first 12 months. We'll pay a cash amount equal to the premiums that have already been paid, but not the cover amount) You won't be asked any health questions when applying.

Age: 50-80

Premium: £5-£100

Payment: When you pass away. There’s no cash in value at any time.

Critical illness cover

Pays a lump sum if you or your child are diagnosed with or have surgery for one of our 52 critical illnesses covered by our plan, within the policy term.

Age: 18-64

Cover: Up to £1,000,000

Payment: If you become critically ill and live for 10 days after diagnosis. There’s no cash in value at any time.

Income protection insurance

Affordable cover that pays a proportion of your lost earnings, which could help you cover your monthly outgoings if you can't work.

Age: 18-59

Cover: Monthly benefit between £500 and £1,500

Payment: If you're ill or injured and can't work. There's no cash in value at any time.

Help take care of your loved ones with an Aviva Trust

Our trusts could give you more control over who your money goes to once you’re gone and will usually be exempt from Inheritance Tax.

Tax liability depends on personal circumstances. Tax rules may change over time. For more information talk to a financial adviser.

Life insurance knowledge centre

Get insight and useful info on protecting you and your family.