What is Wealthify?

If you're thinking about opening an Investment ISA, General Investment Account, or Stocks and Shares Junior ISA, Wealthify could be just what you need to get started. Wealthify helps you invest your money simply, without all the confusing jargon and puzzling charts.

All you need to do is tell Wealthify about your investment goals, how you want to reach them, and the risk level you’re comfortable with.

Remember, investments can fall as well as rise, and you could get back less than you put in.

The tax treatment of your investment will depend on your individual circumstances and may change in the future.

How much it costs

Wealthify believes in keeping fees low and transparent, so you can get the most from your money. Unlike some providers, you won’t be charged to deposit or withdraw money, transfer or close your Plan.

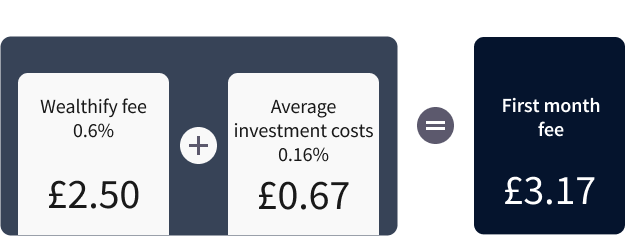

You’ll pay one monthly fee that’s made up of two parts:

Your fee is based on the value of your investments, so the exact amount will change from month to month. Here's an example of what your first month's fee could be if you invested £5,000.

The illustration above is based on an investment of £5000, with a monthly Wealthify charge of 0.6% equal to £2.50, and monthly average investment costs of 0.16% at £0.67. This gives a first-month fee of £3.17. Wealthify charge one fee for management costs, which is calculated on an annual basis but shown as a monthly fee for clarity.

Before you apply

A few things you need to know before you can open an account.

The tax treatment of your investment will depend on your individual circumstances and may change in the future.

To open a Wealthify account you need to be:

- Over 18

- A UK tax resident

- Whether you’re within the maximum allowance each year - currently £20,000 across all ISAs you have, or £9,000 for junior ISA

- Shouldn’t have opened or be contributing to a stocks and shares ISA, other than a lifetime ISA, this tax year (from 6 April to 5 April)

And if you're transferring an ISA, bear in mind:

- It doesn’t count towards your ISA allowance, unless you paid into an ISA this tax year

- You can transfer an ISA you’ve paid into this tax year, but you have to transfer the whole amount

- You might be charged by your current provider, so check before you do anything

- It can take between 3 to 6 weeks to cash in, transfer and reinvest your money – your investments won’t be invested in the markets during some of this time

Set sail on your investing journey

Pick your preferred Wealthify investment account and try out their ‘Build a Plan’ feature, to see how your money could perform over time.

Award-winning investing

Proud winners of Best Personal Finance Online Service 2024/2025

Exploring your options

There's more than one way to make your money work harder. Here’s a few other ways you can do it.

Remember investments rise and fall in value. There’s a chance you’ll get back less than you put in.

Wealthify Stocks and Shares ISA

Invest tax-efficiently with a Wealthify Stocks and Shares ISA, and make full use of your £20,000 allowance each year.

Wealthify General Investment Account

When you want to invest beyond your ISA limit, you could choose professionally managed funds, starting with a lump sum or by making monthly payments. Inflation will reduce the spending power of your money.

Wealthify Junior ISA

Invest for your child with a Wealthify Junior ISA, and help kick-start their financial future.

Top up your knowledge

Whether you're a beginner or keen investor these articles can help with managing your money.

Contact us

Need help with Wealthify?

0800 802 1800

Monday to Friday: 8:00am – 6:30pm

Saturday: 9:00am – 12:30pm

To protect both of us, we may record and monitor telephone calls. These recordings will be saved for at least 5 years. Calls to 0800 numbers from UK landlines and mobiles are free. Our opening hours may be different depending on which team you need to speak to.

_900x506+(1).$16x9-mobile-4cols$.jpg?$16x9-mobile-4cols$)

_900x506.$16x9-mobile-4cols$.jpg?$16x9-mobile-4cols$)