SIPP vs other types of personal pension - what's the difference?

Pensions come in all shapes and sizes, there's no one size fits all option. We explore the differences between a SIPP and other personal pensions below.

Pensions come in all shapes and sizes, and there’s no one size fits all option. Making sure you understand the differences, and pros and cons can set you up for a simple retirement. So, let's talk about the differences between SIPPs and other types of personal pensions.

Your money in your pension is invested, this means the value of your investment can go down as well as up, and you may get back less than you've paid in.

Pensions are a tax-efficient way of saving for your retirement, but note that any tax benefits may change in the future and will depend on your circumstances.

Understanding SIPPs

A Self-Invested Personal Pension (SIPP) is a flexible way to save money for your retirement, from being able to change your payments at the click of a button, to having lists of available investments at your fingertips. It’s a type of personal pension with its own unique qualities.

When you are choosing a SIPP, its important to compare your options and understand the costs involved. If you have a financial adviser, SIPPs can be opened and managed by them directly.

Investment options in SIPPs

SIPPs come with a wide range of investment options; this is the feature that can make SIPPs more attractive when people are deciding what kind of pension they want.

For example, our SIPP offers over 5,000 self-select funds, as well as some ready-made funds and an experts' shortlist. We also offer share dealing, with UK shares, exchange traded funds, and investment trusts.

Benefits of SIPPs

Since a SIPP is classed as a personal pension, payments into it are eligible for tax relief, this means for every 80p you pay in, £1 is added to your pension through basic tax relief. This is however limited to your earnings. For example, anyone earning £20,000 a year would not get tax relief on any pension contributions above that amount. You also have full flexibility when it comes to your investment choices. So, you’ll be able to mix and match your funds and diversify your portfolio to help balance risk.

Flexibility comes with the amount you pay in too, you can open a SIPP with us for £25, or a lump sum of £5,000. You can change, pause, stop, and restart your payments all at the click of a button as well through your MyAviva app.

You may also be able to transfer other pensions into your SIPP. So, if you’ve accumulated pensions over the years from different employers, you may be able to consolidate them all into one place. In some cases you will be required to get advice before transferring and you'll need to pay a fee for this.

SIPPs usually also come with the full range of retirement options. Meaning, if you want to take your money flexibly through drawdown, or want to buy an annuity to give you a guaranteed pension for life, generally a SIPP has you covered. You’ll also be eligible for up to 25% of your pot tax-free when you hit 55 (or 57 from 2028).

Understanding other personal pensions

Other personal pensions works similarly to a SIPP just with a few feature differences. It’s a product that benefits mostly from the same rules as a SIPP, like receiving tax relief, and having a range of funds for you to choose from.

Investment options in personal pensions

Personal pensions still offer a range of investments and investment pathways for you to explore and choose. Investment pathways usually set out to follow a goal that the policyholder chooses. For example, putting money into a lower-risk investment as you reach closer to your retirement age, in hopes of keeping your money safe. This is usually referred to as ‘lifestaging’ or ‘lifestyling’.

Benefits of personal pensions

Personal pensions have very similar benefits to SIPPs. Basic rate tax relief is automatically added up to your pension, up to your earnings limit. Higher and Additional rate tax payers can also claim extra tax relief via self-assessment.

Most personal pensions also allow you to transfer into them, meaning you can consolidate all your pensions in one place. But it’s worth checking the specific policy to make sure this is the case.

Some personal pensions may not have the full choice when it comes to retirement options. So, if you’re considering opening another type of personal pension over a SIPP, first checking the options could set you up for success in the long run. But both a SIPP and other personal pensions will allow you to take up to 25% of your pension tax-free when you hit 55 (or 57 from 2028).

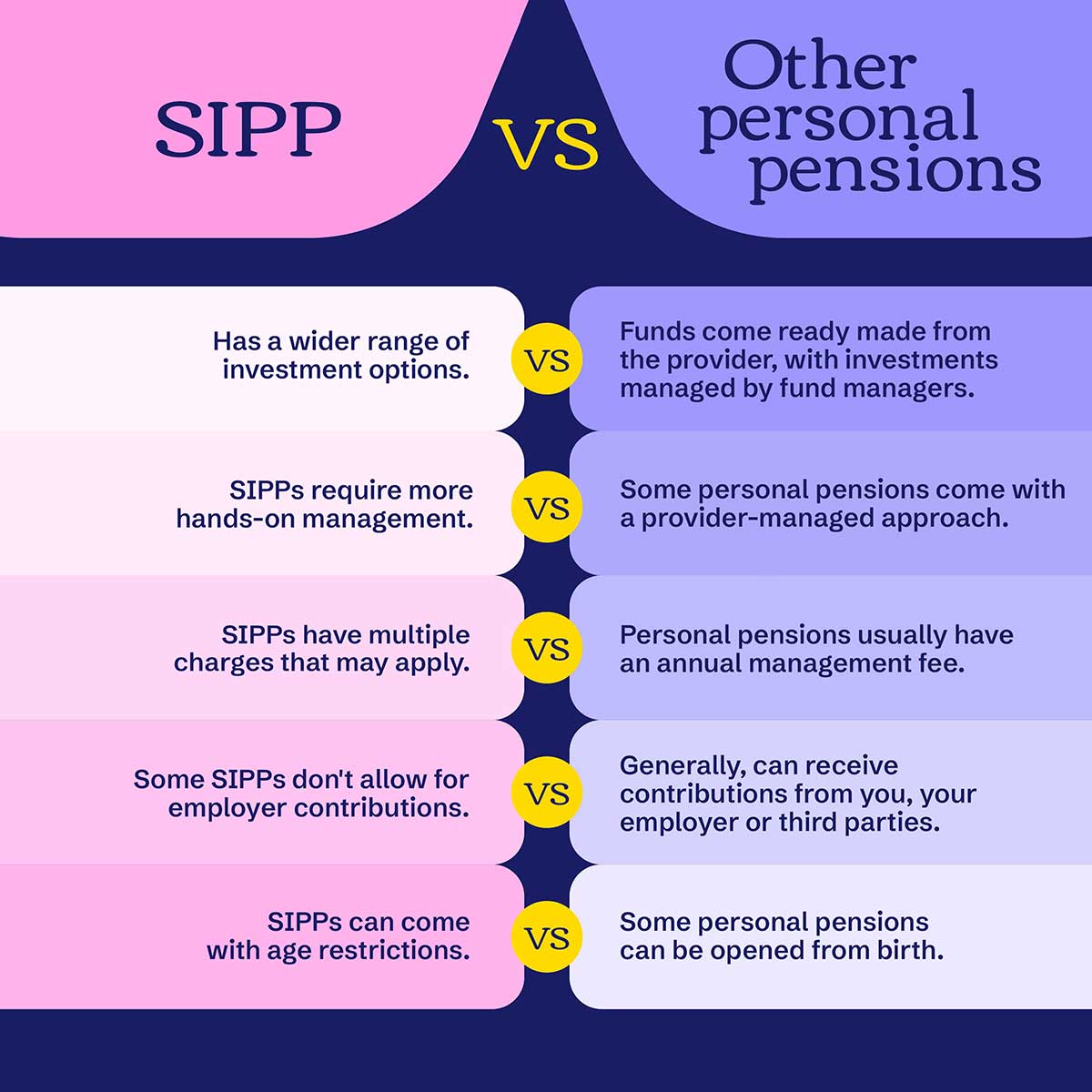

Key differences between SIPPs and other personal pensions

Ultimately, there are only a few differences between a SIPP and other types of personal pension. To expand on the above:

- potentially a fuller range of flexible retirement options.

- a wider range of investment opportunities.

- to be more hands-on when it comes to the management of your SIPP.

- the ability to receive both transfers in and out of it.

- to check it can receive employer contributions depending on your eligibility if this is something you need it for.

- to check the eligibility criteria for opening a SIPP with your chosen provider.

When it comes to other types of personal pensions things to consider may be:

- you potentially won't have the full range of retirement options as the products can be restrictive or old.

- you'll be able to choose from a range of ready-made funds which may be managed by an active fund manager.

- you'll benefit from a provider-managed approach in some cases, meaning you can get on with other things.

- you may have to check on transfers, some personal pensions may allow for transfers out but not in (or the other way round). It will also depend on your eligibility.

- you'll also have the ability to have anyone pay into your pension. For the most part these policies can receive payments from yourself, third parties, and employers.

- you'll be able to set up certain pensions for your dependents from birth.

However, not all pension providers are the same. So, you'll need to check the eligibility criteria before opening a pension.

Pension charges

Each pension will have its own charging structure, but commonly they will have:

- Annual management charge – A charge taken by your provider for holding your money.

- Fund charge – A charge for the fund you’re invested in. It’s worth noting that if you’re in multiple different funds they may all have separate charges.

- Advice fee – If you’re getting advice from a financial adviser they may add a fee onto your pension, rather than charging you directly.